France is one of the foremost economies of the European Union and affords singular prospects for global commerce due to its strategic geographical position, exceedingly developed infrastructure, and steady economic milieu. Initiating a venture in this nation involves not solely the chance to operate within the internal market, but also entry to the markets of other EU nations. Establishment of an enterprise in France necessitates adherence to specific juridical protocols, ensuring transparency and safeguarding investor entitlements.

This document furnishes an intricate manual for enrolling a enterprise in France, from selecting the juridical shape of your enterprise to finalizing all the indispensable juridical formalities. It encompasses facets of selecting a corporation denomination, drafting articles of creation, fiscal matters, licensing stipulations, and additional juridical responsibilities that need to be satisfied to initiate enterprise.

Overview of the business environment in France

France occupies a pivotal position on the economic cartography of Europe, possessing the decemestric largest economy in the world with a gross domestic product (GDP) surpassing US$3,543.00 according to the World Bank for 2023. The nation showcases noteworthy industrial might and inventive capability, rendering enrolling a firm in France here notably appealing for alien financiers.

France extends a steadfast economic milieu upheld by governmental initiatives to invigorate commerce and capital. The establishment of a France enterprise grants entry to a market of over 67 million purchasers and expansive prospects in domains like finance, advanced technology, fabrication, agribusiness, and amenities.

France is placed 22nd in Transparency International's 2022 Corruption Perceptions Index, signifying scanty levels of governmental and corporate venality. This fortifies trust in the nation's judicial framework and fosters propitious circumstances for establishing a business in France.

In terms of investment desirability, France presents a variety of fiscal benefits and backing for pioneering start-ups via public and private investment pools. According to UNCTAD, France ranks among the foremost 10 nations for drawing foreign direct investment, highlighting its pivotal position in the European and worldwide economy.Commencing an enterprise in France is further facilitated by its expansive logistics and transport infrastructure, encompassing one of the most expansive high-velocity railway systems in Europe, global aerodromes, and harbors affording swift entry to principal international and regional marketplaces.

In which sector should I open a business in France?

France offers a variety of business start-up opportunities across a variety of economic sectors, allowing entrepreneurs to find the right niche to start a company. Let's consider the key industries in France in which creating a company promises to be the most profitable.

- Agriculture, forestry and fishing

France is one of Europe's leaders in agricultural production. Registration of a French company in the agricultural sector may be related to the cultivation of grain, viticulture or livestock farming, which are traditionally strong points of the French economy. Forestry and fishing also offer sustainable opportunities, especially in regions with rich natural resources.

- Energy and resources

France is actively developing alternative energy sources, including nuclear, solar and wind energy. Starting a firm in the energy sector can focus on innovative technologies, which is supported by government investment and subsidies in France.

- Manufacturing sector

Manufacturing in France covers a wide range of industries, from automotive to mechanical engineering. Setting up a company in the manufacturing sector can take advantage of highly developed industrial infrastructure and skilled labor resources.

- Textile and clothing industry

This sector is known throughout the world for its high quality and innovative designs, making it an attractive place to start a business targeting the export and domestic high fashion market.

- Food industry

France is famous for its culinary traditions and quality products. Establishing a business in France in the food industry can be a profitable investment, especially if you focus on high quality export products.

- Metallurgical, chemical and pharmaceutical industries

These vocations are the cornerstone for numerous industrial procedures and are of paramount significance. Launching a venture in France in these domains will grant entry to a mature industrial foundation and profound investigation.

- Finance, Banking and Insurance

France has one of the most elaborated pecuniary systems in the cosmos, proffering a potent podium for fiscal novelty and global banking.

- Information Technology

The IT sector in France is burgeoning swiftly, drawing investment in fledgling enterprises and novel technologies. Establishment of an informatics firm can be notably auspicious amidst governmental backing for the digital economy.

- Tourism sector and amenities

The utility sphere in France, notably excursionism, holds a noteworthy function in the economy, drawing millions of sojourners annually. Formulating a firm in this domain could encompass innkeeping, eatery enterprise, or cultural initiatives, offering considerable gainfulness owing to France's universal appeal.The selection of sector to initiate a venture in France ought to consider both the idiosyncratic inclinations of the entrepreneur and the prevailing economic currents in the nation. This will enable you to fully exploit the French commercial milieu and establish a steadfast and prosperous enterprise.

The best cities and regions to start a business in France

A crucial query for entrepreneurs is where to inaugurate a venture in France.

The selection of site for founding a corporation in France relies greatly on the particulars of the sector and the intended clientele. France provides an array of districts with distinct economic, topographic, and cultural attributes that can facilitate various kinds of enterprises prosper.

Paris and Ile-de-France

Paris is not solely the metropolis of France, but also one of the globe's foremost pecuniary and intellectual hubs. Establishing an enterprise in Paris is optimal for domains associated with finance, global commerce, technology, and style. The locale draws enterprises in the IT, nascent ventures, and imaginative fields owing to its exceedingly advanced framework and proximity to the nation's most extensive skilled and diversified populace.

Lyon and Rhône-Alpes

Lyon is France's second grand economic hub after Paris and is renowned for its potent stance in the domains of biotechnology, pharmaceutics, and chemistry. Initiating a venture in this locale is optimal for visionaries aspiring to pioneer in the realms of erudition and medical care. Lyon is also celebrated for its culinary legacy, which renders it appealing for commerce in the dining and excursion sectors.

Marseille and Provence-Alpes-Côte d'Azur

Marseille is the grandest harborage town in France and is the portal to commerce with Mediterranean nations. Enrolling a French enterprise here is exemplary for logistics and conveyance firms. Owing to its littoral whereabouts, the locale is also exemplary for piscatorial and maritime technology enterprises.

Toulouse and the Occitanie region

Toulouse, frequently denominated as the "aerospace metropolis of Europe", is domicile to Airbus and other principal players in the aerospace diligence. Inaugurating a venture in this locality is commendable for enterprises functioning in the aeronautics, celestial industry, and associated informatics sectors.

Bordeaux and Aquitaine

Bordeaux is known for its wine business, which is ideal for starting a company focused on the production and export of wines and alcoholic beverages. The region is also actively developing the green energy and sustainable agriculture sectors, offering opportunities for creating companies in these areas.

Strasbourg and Alsace

Strasbourg, a pivotal polity and scholastic nucleus, is an exemplary milieu for French advisement, exploration, and pedagogic amenities enterprises. The election should be grounded on market scrutiny, asset accessibility, and indigenous fiscal sustenance.

Business regulation in France

Enterprises in France are beholden to a renowned juridical framework that is both stringent and amenable to examination. To enlist and operate an enterprise legitimately, one must be acquainted with the foundational statutes and ordinances. Presented below are significant enactments that affect French enterprise.

Commercial Code (Code de Commerce)

The French Commercial Code encompasses a vast spectrum of facets of mercantile activity, comprising enterprise enrollment, mercantile dealings, and insolvency. This statute governs the genesis of an enterprise, its juridical framework, duties, and obligations of overseers.

Labor Code (Code du Travail)

Labor legislation contains detailed rules relating to employment, working conditions, health and safety at work, and industrial relations. Companies in France are required to comply with these standards when hiring employees, executing employment contracts and dismissing them.

Tax Code (Code Général des Impôts)

The Tax Code, updated in 2022, sets the framework for taxation of individuals and legal entities in France. This code defines the rules for calculating corporate taxes, VAT, income taxes and other tax obligations that every registered enterprise must comply with.

Data Protection Law (Loi Informatique et Libertés)

This statute governs the gathering, handling, and retention of private information. With the emergence of the General Data Protection Regulation (GDPR) in the EU, the legislation has been adjusted to guarantee conformity with novel European confidentiality benchmarks.

Law on the Protection of Intellectual Property (Code de la Propriété Intellectuelle)

The Law on the Protection of Intellectual Property (Code de la Propriété Intellectuelle) encompasses entitlements to monopolies, insignias, authorships, and affiliated entitlements. This edict is consequential for establishments operating in spheres where the security of novelty and imaginative commodities is paramount.These laws form the basis for legislative support and regulation of business activities in France, ensuring a level playing field for all market participants and protecting the interests of consumers, workers and entrepreneurs. Understanding and complying with these laws is key to successfully establishing and operating a company in France.

French regulatory authorities overseeing the activities of companies

When enrolling a firm in France, innovators are confronted with the necessity to engage with diverse regulatory authorities. These entities wield a pivotal function in ensuring adherence to statutes and are accountable for overseeing and bolstering commercial endeavors at every juncture from the inception of a firm to its day-to-day functioning.

Center for Business Formalities (Centre de Formalités des Entreprises, CFE)

The Center for Business Formalities (CFE) plays a central role in the company registration process in France, simplifying the administrative procedures associated with setting up a company. CFE acts as a one-stop shop that allows entrepreneurs to complete all necessary formalities at one place.

CFE functions

Business formality centers are designed to facilitate the launch of a business in France, minimizing bureaucratic delays and simplifying interaction with various government bodies. The main functions of CFE include:

- Supplying documentation. The CFE is accountable for acquiring and managing all requisite paperwork for instituting a corporation, comprising charters of incorporation, enrollment petitions, and authorizations.

- Tax formulation. The bureau furnishes aid in the progression of enrolling a business with the fiscal ministry, ensuring that commitments for value augmented levy (VAT) and corporate levy are recognized.

- National indemnification. The hub additionally engages in enrolling businesspersons in communal indemnification and retirement schemes.

- Ingress into the mercantile and craft registers (RCS/RM). Executes proceedings for enrolling enterprises in the Mercantile Ledger or the Ledger of Craftsmen.

How does CFE work?

A venturer desiring to enlist a firm in France must furnish the pertinent parchments to the adjacent CFE that corresponds to the nature of his undertaking. For instance, mercantile entities resort to the Chamber of Commerce and Industry, and artisans resort to the Chamber of Crafts. Subsequent to scrutinizing the documentation, the CFE enlists the firm in the suitable registries and alerts other governmental bureaus.

Commerce ceremonials hubs furnish invaluable aid in streamlining the process for enrolling a firm in France, rendering commencing a venture more approachable and less bureaucratically dear.

Other regulatory agencies

National Institute of Industrial Property (Institut National de la Propriété Industrielle, INPI)

INPI plays a key role in the registration of intellectual property, including patents, trademarks and designs. For firms, especially in sectors related to innovation and technology, interaction with INPI is critical to protect their developments and brands.

Chambers of Commerce and Industry (Chambres de Commerce et d'Industrie, CCI)

Chambers of Commerce and Industry provide support to companies as they set up and develop in France, offering advice, training and networking assistance. CCIs also often act as registration centers for new businesses, assisting with business start-up and ongoing administration..

Directorate of Taxes and Duties (Direction Générale des Finances Publiques, DGFIP)

The DGFIP is responsible for tax matters, including the collection of corporate taxes, VAT and income taxes. This body is necessary for any enterprise to register with the tax authorities and submit a tax return.

Directorate General for Competition, Consumer Affairs and Fraud Prevention (Direction Générale de la Concurrence, de la Consommation et de la Répression des Fraudes, DGCCRF)

The DGCCRF oversees adherence with rivalry, client safeguard, and deceit interception statutes in the commercial milieu. This entity guarantees equitable rivalry and elevated norms of business methodologies.

National Office of Freedom and Information Science (Commission Nationale de l'Informatique et des Libertés, CNIL)

The National Commission for Information Science and Freedom (CNIL) governs the utilization of individualized information, ensuring adherence to the requisites of the legislation "On Erudition Technology, Archives, and Entitlements" and the European GDPR Regulation. Enrollment with this commission and rigorous observance to its regulations are compulsory prerequisites for lawful commerce in France for enterprises that administer the individualized information of their patrons or staff.

Each sovereignship agent implicated in the regulation of commerce endeavors performs a pivotal function in securing constancy and prescience for the Gallic economic milieu, thereby fostering economic augmentation and enterprising endeavor. Cognizance of the extant functionalities and regulative requisites of each of these institutions will empower entrepreneurs to efficaciously commence and burgeon their enterprise in France.

Business registry systems in France

In France, sundry scrolls are proffered for inaugurating a concern and conducting commerce, each of them bears responsibility for a particular sort of pursuit:

- Register of trading companies , intended for commercial organizations.

- Directory of craft companies (Répertoire des Métiers, RM), which covers craft businesses.

These registries not only formalize the process of starting a business, but also ensure its legal transparency.

Trade Register (Registre du Commerce et des Sociétés, RCS)

The RCS Commerce Ledger is designated for enrollment of juridical entities and solitary enterprisers conducting trade endeavors. This is the principal ledger employed to inaugurate enterprises in France. The significance of RCS is to warrant lawful perspicuity and reachability of intelligence about commercial entities to governmental bureaus, associates, and patrons.

Key points for registering with the Register of Commerce and Companies (RCS):

- Offering of manuscripts. To enroll an association with RCS, you must furnish a collection of rudimentary constituent manuscripts, encompassing a constitution, an index of progenitors and overseers, as well as affirmation of a lawful domicile.

- Legitimate valuation. The tendered manuscripts are scrutinized to ascertain their accord with the standards of extant jurisprudence.

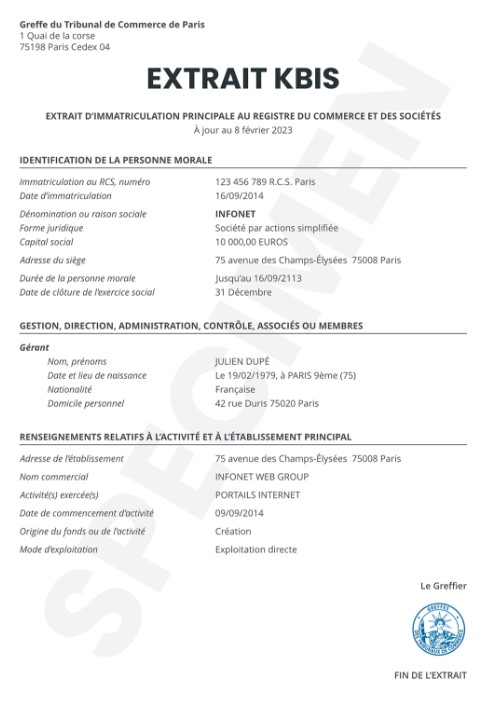

- Acquiring a registration proclamation. Subsequent to accomplishing the enrollment modus operandi of the association, a Kbis excerpt is dispensed, authoritatively affirming the juridical subsistence of the enterprise in France and encompassing pivotal particulars regarding it.

Fundamental prerequisites for commencing an enterprise in France

To efficaciously inaugurate a commerce in France, you necessitate to consider a plethora of cardinal facets that are governed by indigenous statutes. These prerequisites pertain to both indigenous and extraneous merchants aspiring to institute a commerce in this jurisdiction.

Selecting a concern appellation

Setting up a concern in France involves examining the suitability of an epithet, ensuring it's unmatched and doesn't trespass on tertiary parties' prerogatives, and reaching out to the National Institute of Industrial Property.

Development of the organization's charter

A corporation's charter, comprising governance structure, progenitor obligations, and validated funds, is vital for matriculation. All records must be validated and deposited with the accredited matriculation entity.

The magnitude of the sanctioned capital

Endowment of the sanctioned pecuniary is one of the most crucial facets when inaugurating a corporation in France, as it epitomizes the quantum of funds that the progenitors contribute to commence activities. The magnitude of the sanctioned pecuniary is delineated by the guise of the organization’s juridical status.

|

Legal entity form |

Extent of the sanctioned principal |

Additional terms |

|

Enterprises limited by guarantee (SARL) |

1 € |

Attractive for small and medium enterprises |

|

Joint stock companies (SA) |

37,000 € |

Compulsory to remunerate 50% at enrollment, which is applicable for substantial endeavors. |

|

Simplified Joint Stock Companies (SAS) |

Set by the founders, minimum 1 € |

Flexibility for start-ups and international firms |

|

Sole Proprietorships Limited by Liability (EURL) |

1 € |

Available for individual businesses |

|

Limited companies (SNC) |

Not determined |

Each partner makes a contribution, which can be monetary, in kind or in the form of services |

This chart enables you to speedily juxtapose the sundry prerequisites for sanctioned principal contingent on the elected juridical configuration of the enterprise.

The importance of having a registered business address in France

The statute mandates that each enterprise in France must possess an officially enlisted domicile. It is utilized as the lawful domicile for all formal intents, encompassing fiscal correspondence and juridical notifications. The enlisted domicile may be either the corporeal domicile of the enterprise or an abode rendered by service enterprises that furnish lawful domiciles for enterprises.

Extract from the Register of Trade and Companies (RCS)

Following an establishment in France has been enrolled, it acquires a parchment from the Register of Trade and Companies (RCS). This manuscript, which is an authenticated testament of the juridical condition and subsistence of an establishment, is imperative to execute a multitude of maneuvers, encompassing inaugurating banking repositories, finalizing compacts, and engaging in solicitations.

Step-by-step guide to registering a company in France

Commencing a venture in France is a meticulous procedure that demands stringent conformity to indigenous juridical requisites. Herein lies a systematic blueprint that shall aid entrepreneurs in effectively initiating an enterprise on French soil.

Step 1: Determination of the enterprise's general fund

Prior to commencing the enrollment procedure, selecting a commercial possession configuration is paramount. Your selection should hinge on the magnitude of the enterprise, the count of initiators, and their degree of individual pecuniary liability.

Step 2: Selecting and registering a business name

Ensure that your commercial appellation is singular and reachable. This task can be accomplished via the National Institute of Industrial Property (INPI) or employing internet utilities. Verify that the chosen appellation has not heretofore been enlisted and is not shielded as a hallmark.

Step 3: Prepare documentation

It is imperative to fabricate a charter of the establishment embodying enlightenment about the appellation, locale, objectives of pursuit, quantum of sanctioned pecuniary assets, as well as identifying data of the progenitors and overseers. Furnish exhaustive enlightenment regarding each of the progenitors and stewards, encompassing their appellations, locales, and vocations. All pivotal genesis manuscripts must be ratified, which might necessitate the attendance of the progenitors or their surrogates.

Step 4: Register a bank account

It is indispensable to inaugurate a corporate reckoning with a pecuniary establishment and lodge accredited assets into it. The pecuniary establishment will dispense a capital deposit testimonial, which is requisite to consummate the enrollment process.

Step 5: Register with the Center for Business Formalities (CFE)

Contact the appropriate Center for Business Formalities (CFE), selecting the appropriate authority based on your area of activity:

- Commercial company - to the Chamber of Commerce and Industry.

- Craft company - to the Chamber of Crafts.

- An agricultural company - to the Chamber of Agriculture.

Step 6: Obtaining an official extract (Extrait Kbis)

After registration with RCS, a Kbis extract is issued - a special act that confirms the legal existence of your enterprise in France. This statement is required for various business transactions such as entering into contracts and participating in tenders.

Adherence to all these measures will guarantee the licit and thriving establishment of the enterprise in France, which will empower you to initiate the business on a robust legal foundation..

Catalog of manuscripts for inaugurating a corporation in France

Establishing a concern in France necessitates concocting and proffering a parcel of papers that must adhere to specific juridical prerequisites, encompassing notarization and lodgment. All parchments must be tendered in French or transmuted into French if they were initially inscribed in a foreign tongue.

Basic paperwork for founding a company in France:

- Indenture of the establishment (Statuts)

This principal component statute comprises the appellation of the establishment, its formal domicile, scope of operation, particulars regarding the endowed capital, along with intelligence concerning the originators and administrators.

The manuscript needs to be attested by a notary. Certain categories of businesses, such as SARL (limited liability company), necessitate notably meticulous adherence to the format and substance of the constitution.

- Enumerate the originators and overseers (Liste des souscripteurs)

Catalog of individuals subsidizing the sanctioned capital, detailing their appellations, residences, and sum of subsidy. In the case of corporate entities, this index is disclosed concurrently with the memorandum of association.

- Declaration of appointment of directors (Déclaration des bénéficiaires effectifs)

Signifies persons who wield considerable influence over the administration and functioning of the enterprise. This is mandatory for all enterprises and must be recorded in the commercial register.

- Verification of the juridical domicile of the establishment

This might include a tenement, habitation transfer, or proprietor attestation, ensuring the lawful inhabitation is ratified and apt for commerce.

- Attestation of benefaction of the sanctioned endowment (Certificat de dépôt des fonds)

Financial institution attestation ratifying the allocation of the accredited principal into a dedicated deposit preceding finalization of the enrollment procedure. Granted by the financial institution subsequent to transmitting the necessary funds.

Varieties of mercantile establishments in France

Pioneers in France have the opportunity to select from diverse juridical frameworks, each with distinctive characteristics, prerequisites, and customized for particular business intents.

- Limited liability company (SARL – Société à Responsabilité Limitée)

- The gist: A SARL is similar to an American LLC and is popular among small and medium-sized businesses due to its adaptability and relatively uncomplicated management structure.

- Requirements: A minimum of one person (individual or juridical) is needed as a progenitor. The quantum of the sanctioned pecuniary is a symbolic quantum (1 €), and each subscription must be officially inscribed.

- Suitable for: small firms that require a flexible management structure and do not require external financing.

- Joint Stock Company (SA – Société Anonyme)

- The bottom line: SA is ideal for large-scale projects and is often chosen by companies planning to go public. Requires stricter governance structure and regulations.

- Stipulations: a minimum of seven stockowners are requisite, and the sanctioned principal must be no less than 37,000 €, with half of its sum contributed at the juncture of enrollment.

- Suitable for: Large projects and companies seeking to go public or raise significant external capital.

- Simplified joint stock company (SAS – Société par Actions Simplifiée)

- The bottom line: SAS stands out for its flexible management and limited liability of its members, making it a popular choice for start-ups and international enterprises in France.

- Stipulations: can be ascertained by one or more stakeholders, whether individuals or juridical entities. The sanctioned principal is determined by the initiators.

- Suitable for: Start-ups, international organizations and those seeking flexibility in corporate governance without strict regulatory restrictions.

- Full partnership (SNC – Société en Nom Collectif)

- The bottom line: Under an SNC, each partner assumes unlimited obligations, which gives the right to use personal funds to satisfy the company's obligations.

- Stipulations: Two or more participants required. There is no sanctioned capital; Each associate renders a contribution, which could be pecuniary, in kind, or by means of amenities.

- Suitable for: Entrepreneurs who are willing to share risk and management with other partners and have complete trust in each other.

These configurations offer a range of choices for entrepreneurs based on their particular requirements, magnitude of enterprise, and desired degree of accountability. Selecting the appropriate juridical configuration of a company is crucial to safeguarding the concerns of proprietors and maximizing fiscal efficiency.

Overview of corporate taxation in France

The tributary framework for enterprises in France is delineated as multi-stratified and intricate. This arrangement encompasses assorted levy ratios for both denizens and non-dwellers of French dominion. It further fluctuates contingent on the essence of the earnings and the sector of enterprise. This segment scrutinizes pivotal levies, incorporating personal gain levy, corporate gain levy, and value incremented levy (VAT). The manuscript underscores the examination of their schedules and provisions, founded on the juridical condition of the firms and their fiscal accomplishments.

Corporate Tax Rate (IS)

Corporation tax on income earned by companies is regulated as follows:

- For non-profit organizations, the tax rate on income from assets is set at 24%, while income from movable property is taxed at a rate of 10%.

- Companies whose annual turnover does not exceed 10 million euros are subject to a reduced rate of 15%. The same rate applies to small and medium-sized enterprises whose annual income does not exceed 38,120 euros.

Value added tax (VAT) rate

Regarding VAT in France, it allows for the utilization of diverse tariffs, thus ensuring adaptability in levies contingent on the classification of commodities and amenities:

- The standard VAT rate is 20%.

- There are furthermore curtailed VAT proportions: 0%, 2.1%, 5.5% and 10%. This facilitates fiscalization to adjust to the attributes of commodities or amenities that possess societal import or aid bolster specific segments of the economy.

Banking services for corporate clients in France

In France there is a multiplicity of banks rendering amenities to corporate patrons. Here are some of the most renowned banks in France and the accommodations they provide:

|

Bank |

Services for corporate clients |

Features of the financial institution |

|

BNP Paribas |

-Opening business accounts - Lending - Liquidity management -Consultations on financial planning and investment - Services for working with international markets |

The largest bank in France with an extensive international network and extensive experience working with corporate clients. |

|

Crédit Agricole |

- Accounts for legal entities - Lending - Investment decisions - Financial flow management - International trade services |

One of the leading banks in France, specializing in servicing agricultural enterprises and other corporate clients. |

|

Société Générale |

- Cash flow management - Lending - Investment products - Risk management services - Trading operations |

It has a wide range of services for business clients, including trading and risk management, supporting the international operations of companies. |

|

BPCE (Banque Populaire Caisse d'Epargne) |

- Financial accounts - Lending - Investment products - Financial advice |

It is formed from a group of regional banks offering services to both corporate and private clients, with a focus on regional markets. |

|

Calyon (Crédit Agricole Corporate and Investment Bank) |

-Corporate finance - Investments - Trade - Asset Management |

Specializes in investment and corporate banking services, offering financial solutions for corporate clients. |

|

Groupe Caisse d'Epargne |

-Financial management - Lending - Investments - Trading operations |

It has a structure that unites regional banks and provides a wide range of services to corporate and private clients in France. |

|

Credit Mutuel – IFRS |

- Bank accounts - Lending - Investments - Insurance |

It possesses a collaborative framework and is concentrated on fulfilling the requirements of its constituents, providing an extensive array of financial and assurance amenities. |

To inaugurate a commercial tally in a French depository, you will necessitate:

- Selecting a pecuniary establishment and account ilk. Post enrollment, elect the depository that proffers the superlative stipulations for your firm. Distinct repositories may tender disparate categories of enterprise accounts, thus it's pivotal to elect the apt one.

- Provisioning of manuscripts. Customarily, you will be required to furnish manuscripts such as charters of establishment, proprietor identification, enrollment manuscripts, etc.

- Consummating the petition. Subsequent to selecting a depository, you might be mandated to consummate a petition to inaugurate an account and furnish the requisite manuscripts.

- Affixing the compact. Post scrutinizing your petition and the supplied parcel of manuscripts, the depository will accede into an accord with you to enroll a corporate account.

Upon completing these measures, you will be able to utilize a corporate account at a French bank to conduct fiscal operations pertaining to your enterprise.

Residence permit on a merchant card in France

Schemes to allure benefactors via the issuance of domicile grants (RPs) have emerged as a voguish instrument in numerous nations to foster economic expansion and entice overseas capital. One of such schemes is the chance to procure a domicile permit in France for 3 years employing a trader card (Carte de Commercant) in return for capital deployments in the economy totaling €300,000.

French abode leave involves a meticulous scrutiny of an investor's fitness criteria, encompassing years, pecuniary steadiness, and malefactor chronicles. The investor subsequently registers in a gateway or seeks succor. They proffer essential documents, journey warrants, and validation of contributions to the country's financial system. Authorities evaluate the investor's venture and its repercussion on the economy.

If the petition and investment are sanctioned, the benefactor is bestowed a merchant card and a triennial habitation permit, enabling them to engage in commerce and invest in France.The possessor of a tradesman card is obligated to adhere to the terms established for its utilization, including ongoing expenditure in the nation's economy. Following the three-year duration of validity of the residency license, the financier can seek its extension, presenting proof of sustained investment and adherence to other stipulations.

Advantages of starting a business in France

Commencing a venture in France can be alluring owing to several noteworthy advantages, comprising:

- Tactical situation. France possesses an esteemed geographical position at the heart of Europe, affording straightforward entry to expansive EU markets. This renders the nation appealing to individuals intending to conduct commerce within the European market.

- Robust economic prowess. France stands as one of the foremost economies globally with a multifaceted and kinetic commerce sphere. The nation's economic landscape is marked by a profound degree of ingenuity and an array of sectors, fostering abundant prospects for commercial endeavors.

- Propitious commerce milieu. In recent times, the French administration has implemented measures to ameliorate the commerce milieu in the nation, including diminishing levies and streamlining enrollment protocols for enterprises. This fosters more propitious circumstances for enterprise and enticing investment.

- Access to finance. France possesses a sophisticated financial framework, encompassing an extensive array of banking amenities and financial establishments capable of furnishing financial backing and investment for enterprises.

- Excellence personnel. France is renowned for its excellence personnel and erudite experts in diverse domains. The existence of exceedingly skilled experts can markedly streamline the recruitment of personnel and guarantee the enduring functioning of the enterprise.

- Infrastructure and technologic unfolding. France possesses a sophisticated superstructure, encompassing conveyance grids, telecommunication, and a technologic substratum, which expedites the effective functioning of commerce and grants entry to cutting-edge technologies and novelties.

- Ethnic and societal heterogeneity. France is a polyglot society with an opulent cultural patrimony and assorted communal mores. This fosters a propitious milieu for commercial undertakings, notably those oriented towards global markets and multinational cohorts.

Conclusion

Inaugurating a firm in France is a strategically momentous stride for entrepreneurs who desire to broaden their business internationally. Thanks to its propitious business ambiance, pioneering milieu, and entry to global markets, France presents singular prospects for the prosperous evolution of enterprises in diverse sectors.

TK DEAL is prepared to furnish exhaustive aid and proficient counsel on the route to enrolling and conducting commerce in France. We possess a profound comprehension of regional market circumstances and statutory stipulations, enabling us to assist our patrons in realizing their objectives within a specified jurisdiction..

Obtain a French Tech Visa: A Pathway for Innovative Business Founders

Obtain a French Tech Visa: A Pathway for Innovative Business Founders