Registering a company in Lithuania is a prevalent device for executing entrepreneurial exercises of different scales due to the country's integration into the legitimate and financial framework of the European Union. Lithuania is regularly considered a vital "bridge to Europe". Due to its exceedingly created showcase economy, favorable monetary conditions and moderately good commerce costs, enrolling a company in Lithuania is considered one of the most satisfactory choices for beginning a small and medium-sized business.

Business enrollment in Lithuania gives potential pioneers and extremely useful proprietors with a bound together inner advertisement, streamlined components for cross-border commerce, and a compelling venture security framework. Due to a steady macroeconomic environment, favorable monetary administration, and straightforward administrative instruments, Lithuania draws in both little and medium-sized businesses and transnational enterprises interested in expanding their resources and deliberately creating in the European region.

State administrative bodies are taking measures to guarantee straightforwardness of speculation strategies, end conceivable obstructions to cross-border development of monetary assets, and create an ideal competitive environment that advances the advancement of imaginative trade models. Such comprehensive commerce control in Lithuania not as it were invigorates the fascination of remote coordinate speculation, but moreover lays the establishment for economical financial development by actuating entrepreneurial activity.

The key divisions for doing commerce in this ward are coordinations and transport, budgetary innovations, IT ventures, cryptocurrency, new companies, development and industry. The opportunity to get EMI licenses in Lithuania is particularly prevalent. This article clarifies the key administrative viewpoints controlling the enlistment of legitimate substances in the region of the Republic of Lithuania, counting the strategy for recording constituent arrangements, prerequisites for the least authorized capital, rules for recognizing and confirming useful proprietors, as well as issues of corporate administration, tax collection, bookkeeping.

Benefits of registering a business in Lithuania

Worldwide enterprises as of now working in the Republic of Lithuania emphasize the accessibility of exceedingly qualified human assets, created framework, moo taken a toll of beginning and overseeing a commerce as crucial components deciding the country's venture allure. Lithuania, which has a pan-European recognized competence in advanced innovations and illustrates tall rates of proficient preparing, reliably holds a driving position among European nations in the number of employments made as a result of outside coordinate speculation ventures, which affirms its status as a deliberately imperative financial center in the region.

Ranked in the Global Entrepreneurship Monitor (GEM) 2024/2026, Lithuania holds a solid position among worldwide trade center points, highlighting its profoundly created, imaginative and economical commerce foundation that underpins entrepreneurial development. The key benefits for those arranging to enroll a company in Lithuania are outlined below.

Affordable costs for company enlistment and administration

Lithuania is one of the most alluring locales for business people wishing to register a company in the EU. One of the fundamental preferences is the moo taken a toll of enlistment and trade organization, which has made the nation available not as it were to expansive speculators, but too to new companies. With authoritative boundaries minimized, the toll of enrollment and ensuing support is essentially lower than in most Western European countries.

Fast company enlistment prepare in Lithuania

The enlistment method in the domain of the Republic of Lithuania is characterized by a tall degree of productivity, which is due to the digitalization of state and regulatory forms. Lithuania, being one of the most innovatively progressed purviews in the European Union, gives business visionaries the imaginative electronic framework, which altogether optimizes the forms of enlistment and consequent commercial activities.

Government organizations are executing advanced interaction components, which encourages the computerization of law requirement strategies, minimization of bureaucratic costs and quickened report stream. An extraordinary part in this framework is given to the utilization of progressed arrangements in the field of electronic residency, inaccessible distinguishing proof, which permits commerce substances to essentially decrease the time and money related costs related with trade enlistment in Lithuania.

No dialect barrier

Lithuania is a nation where English is broadly utilized in commerce circles, particularly in the commerce and administrations segment. The advantage of this is that for outside business people who do not speak Lithuanian, the preparation of doing trade gets to be as helpful as possible. Most lawful, bookkeeping and authoritative administrations are accessible in English, which makes a difference to essentially decrease communication and organizational costs.

Opportunity to get a home allow in Lithuania through investment

One of the key points of interest of enrolling a trade in Lithuania is the opportunity to get a home allowed through venture. Beneath the terms of this program, outside candidates have the opportunity to get a home allowance in Lithuania, which can be issued on the premise of critical capital speculations in the creation or advancement of commercial endeavors. The terms of the program accept that ventures ought to be coordinated towards the advancement of imaginative ventures or the creation of employment, which makes a difference to fortify the country's economy.

Availability of free zones with charge breaks

Lithuania has propelled extraordinary zones that offer critical monetary and authoritative benefits to companies enlisted in their region. Companies are excluded from salary charge for the to begin with a long time of operation, and get extra inclinations in property charges, VAT, and other required installments. Setting up companies in Lithuania's free financial zones gives the opportunity to get a full or halfway monetary postponement in corporate taxation.

Investors who contribute capital to companies consolidated in the SEZ have got to 0% corporate charge for the to begin with 10 a long time, and a decreased rate of 7.5% for the another 6 a long time, along with exclusion from property assess and profit assess. A permit is required to work a trade in the SEZ, and the taking after conditions must be met to get charge benefits:

- investments of at slightest 1 million euros (or 100 thousand euros);

- creation of at slightest 20 jobs;

- 75% of the company's salary must come from exercises inside the domain of the SEZ.

No monetary burden on CT for new companies in the to begin with year

If you are interested in starting a company in Lithuania, if you don't mind, note that lawmakers effectively bolster new companies and little businesses, making favorable conditions for their advancement. In the course of actualizing the state approach to invigorate business enterprise, new companies that meet certain criteria may be absolved from paying pay charge on benefits in the to begin with year of their operations. For little businesses whose yearly wage does not surpass EUR 300,000, and the number of workers is up to 10 individuals, and whose proprietors do not take part in the administration of other lawful substances, a charge motivating force on benefit assess is given, communicated in a 0% rate in the to begin with year of the company's operation, with a move to a 6% rate beginning from the moment year.

When contributing in huge ventures, non-residents have the opportunity to apply 0% corporate charge for up to 20 a long time. The conditions for accepting this charge advantage are the taking after requirements:

- the venture volume, affirmed by the inspector, must be at slightest 20 million euros;

- number of staff - from 150 people;

- The company's exercises must be centered on the field of innovation or production.

Possibility to open a company remotely in Lithuania

One of the critical focal points of enlisting a company in Lithuania is the capacity to open a company remotely, without the requirement for the individual nearness of the pioneers. This is particularly critical for remote candidates. To do this, it is sufficient to issue a control of a lawyer, which will permit a third party to carry out all the vital legitimate strategies on behalf of the author, counting recording arrangements with government organizations and concluding contracts with lawful and bookkeeping services.

In expansion, opening a company in Lithuania gives rise to a powerfully creating startup framework, which incorporates various commerce hatcheries, increasing speed programs, and specialized “regulatory sandboxes” that give adaptable adjustment of new businesses to the current administrative system. These instruments make favorable conditions for testing imaginative trade models and advances in a controlled environment beneath the supervision of competent government offices, which, in turn, makes a difference to minimize lawful dangers and streamline the preparation of coordination of new businesses into the country's financial framework.

Forms of companies in Lithuania

The Law on Companies controls the method for the foundation, operation, reorganization and liquidation of companies in Lithuania. The said administrative act sets up a list of organizational shapes of endeavors allowed for enlistment by outsiders and inhabitants, and moreover decides their legitimate capacity, corporate administration components, property risk issues, tax assessment administration and money related reporting.

In expansion, the said standardizing act contains arrangements concerning the assurance of the rights of leasers and financial specialists, antitrust direction issues, conformance with the standards of reasonable competition, corporate straightforwardness and anticipation of money related manhandle. Control of trade exercises in Lithuania in agreement with the arrangements of the above-mentioned law covers viewpoints related to the cross-border exercises of undertakings, counting the conditions for opening branches and agent workplaces of remote organizations in the region of the Republic of Lithuania, the strategy for recognizing lawful substances built up in the wards of the European Union, and the specifics of applying worldwide legitimate standards in the field of corporate regulation.

According to national enactment, enlistment of a company in Lithuania by a non-resident is allowed in the shapes of a private undertaking, association (full or constrained), restricted obligation company, open company. In real hone, the most often as possible chosen shape is Uždaroji akcinė bendrovė (UAB). It is vital to note that this shape of organization gives noteworthy adaptability in administration, counting the right to designate non-residents as official people, which in turn contributes to the enhancement of operational exercises and the administration structure, making UAB alluring to worldwide business people looking to grow their exercises in Lithuania.

Registration of UAB company in Lithuania - conditions:

- Capital: 2500 euros, the sum must be exchanged to the company's corporate investment funds account some time after its official registration.

- Shareholder - can be either a person or a corporate substance (up to 250 shareholders) of any home, with the exemption of residency in nations beneath worldwide sanctions.

- Director - this position can as it were be held by an person. The director's exit from home is not constrained, with the exemption of nations subject to sanctions. The chief can too be a shareholder of the company.

- Secretary - the arrangement of an individual to this position is optional.

- The enrollment of recipients is public.

- Public data incorporates the title of the company, its lawful address, the sum of the authorized capital, data of the executive, shareholder and beneficiary.

- The legitimate address of the company must be found inside the Republic of Lithuania.

The essential advantage of selecting a UAB in Lithuania is the imprisonment of the property hazard of the pioneers, concurring to which commitments to banks are fulfilled exclusively within the limits of the company's property, without counting the personal assets of shareholders and extraordinary beneficiaries. This rule of corporate law is one of the key components for securing the property interface of examiners, diminishes exchange threats and energizes the interest of capital, in this way ensuring the strength of budgetary activity and the consistency of commercial relations.

Registration of a joint-stock company in Lithuania is the most common outline for commerce substances centered on medium and broad businesses. An open company (AB) has the status of a free authentic substance, which ensures its restriction from the pioneers. In assention with authoritative courses of action, the pioneers who have chosen to open a joint-stock company in Lithuania will bear limited property hazard, the entirety of which is limited by the whole of their commitments to the capital.

The law stipulates that the slightest capital at the time of establishment must be at least 40,000 euros, which serves as a guarantee of the company's money related robustness and affirmation of creditors' interface. At the same time, legal controls do not set up a most noteworthy number of individuals, which makes this shape of legal substance engaging for large-scale hypothesis wanders and licenses for resulting open issue of offers with the credibility of their circulation on the stock showcase.

The administration of a joint-stock company is carried out either by a sole official body spoken to by the executive, or by a collegial body in the shape of a board. In order to guarantee straightforwardness of commerce exercises and conformance with money related guidelines, a joint-stock company is subject to required yearly review of monetary statements.

Foreign candidates can build up an organization in Lithuania, counting a general or (TUB) and limited (KUB) association. A common association does not have the status of an autonomous lawful substance and works on the premise of an organization assention, which is the key constituent record, obligatory for notarization and marked by all members of the association. This understanding builds up the primary angles of the partnership's working, counting the dispersion of rights, commitments and obligations of its members, the number of which, in agreement with legitimate arrangements, can shift from two to twenty. A fundamental highlight of this organizational shape is the boundless backup obligation of each accomplice for the commitments of the association, which implies the plausibility of fulfilling creditors' claims both at the cost of the resources of the organization and at the cost of the individual property of the participants.

Unlike the TUB, the constrained organization is characterized by a separated conveyance of risk between the members, isolated into common and quiet accomplices. The overseeing accomplices, whose number cannot be less than one, bear boundless obligation for the partnership's obligations, whereas quiet accomplices (the least number is one) constrain their dangers only to the sum of cash they store in the capital. A comparison of the primary characteristics of these legitimate shapes is underneath.

|

Legal form (abbr.) |

Obligations of the pioneers |

Number of participants |

Minimum capital |

Who performs management functions? |

|

UAB |

Limited liability |

1-249 shareholders |

2500 EUR |

Director |

|

IE |

Unlimited personal liability |

1 owner |

Not defined |

The owner is the director of the company, although another person may be appointed to this position. |

|

A.B. |

Limited liability |

The number of shareholders is not limited. |

40 thousand EUR |

Sole director or collegial body (board) |

|

KUB |

1-20 partners |

The amount of contributions is determined by the participants. |

Meeting of members (appointment of a representative is mandatory). OR Sole manager (director) |

|

|

TUB |

Unlimited joint and several liability |

Transnational corporations are provided with the opportunity to open a branch in Lithuania or establish a representative office in the Republic of Lithuania. However, in accordance with the current legal regulations, at least one of the authorized officials vested with management functions must have the status of a permanent resident within this jurisdiction. It is important to note that the above organizational forms do not have the status of independent legal entities, and therefore do not have a separate legal personality, which implies complete dependence on the parent company in matters of business activities, in terms of financial and legal liability to third parties and government agencies.

A branch has legal capacity within the limits defined by the constituent indentures and power of attorney, which allows it to carry out entrepreneurial activities, conclude transactions, conduct settlements with counterparties, and implement other commercial functions identical to the activities of the main legal entity. A representative office, unlike a branch, performs exclusively representative functions aimed at protecting the interests of the parent company, conducting marketing research, establishing business connections, negotiating, and performing other non-commercial actions not related to independent profit-making.

From the point of view of corporate and tax legislation, a branch is usually subject to mandatory registration with the relevant government agencies of the country and can act as a taxpayer on a general basis, while a representative office acts in the interests of the parent company and, in most cases, does not bear an independent tax burden. The essential difference between these two forms is management: while a branch may have its own manager, empowered to act on behalf of the organization without a power of attorney within the limits of his competence, a representative office is usually managed by an authorized person, whose powers are limited by the power of attorney issued by the head office.

Company registration process in Lithuania

Enlistment of a company in Lithuania starts with the choice of the organizational frame, each of which is characterized by particular legitimate highlights. This choice involves particular controls concerning the lawful capacity and commitments of the venture, a number of other viewpoints, counting the obligation of pioneers, corporate administration highlights, least capital necessities and controls concerning the dissemination of benefits. These contrasts moreover cover tax collection issues, bookkeeping and announcing commitments, arrangements concerning the company's connections with third parties, counting the plausibility of pulling in speculations, and the specifics of liquidation and reorganization.

Further stages of company enlistment in Lithuania:

- Reservation of an interesting name.

- Preparation and execution of constituent arrangements that must comply with built up requirements.

- Payment of enrollment fee.

- Submission of an application to the competent specialist, went with a full set of indentures.

The last enlistment is affirmed by the issuance of a certificate of consolidation and task of an interesting company code, after which the commerce substance procures lawful capacity and can lawfully carry out commercial operations in Lithuania and overseas. After effectively completing the enrollment strategy, it is essential to open a corporate account in Lithuania, guaranteeing that future trade exercises comply with the built up measures, counting getting the essential licenses and endorsements depending on the nature of the activity.

To enroll in a company in the Republic of Lithuania, it is essential to plan and yield a number of agreements. Among the required arrangements is an act marked by all pioneers, certifying their assent to the joining of the company. In expansion, it is essential to give the Articles of Affiliation of the undertaking, containing data around the title of the lawful substance, its objectives, the rights and commitments of the pioneers, the administration bodies and their powers.

An critical component of the bundle of agreements for company enlistment in Lithuania is the accommodation of comprehensive data approximately the chiefs and pioneers, counting their full recognizable proof information, arrangements affirming their legitimate capacity and the nonappearance of deterrents to the execution of the pertinent obligations in the founder's and administrative part. A required prerequisite is affirmation of the opening of an account in one of the neighborhood banks, to which the least capital sum decided by the current enactment has been transferred.

In order to optimize the preparation and minimize the hazard of legitimate mistakes, it is prescribed to utilize the proficient back of qualified experts with encounter in corporate law and arrange bolster in enlisting a company in Lithuania. This will essentially speed up the preparation of getting the official status of a company, guarantee full conformance with all legitimate conventions, which will essentially increment the level of lawful unwavering quality and conformance with administrative necessities at all stages of trade creation.

In what field to open a company in Lithuania ?

Lithuania, being a member of the European Union and located in the strategic region of the Baltic Sea, has been holding the lead among European destinations for businessmen seeking to start a business from scratch for many years. The country is characterized by a stable economy, progressive legislation, and active technologization. Among the sectors that particularly attract the attention of representatives of the business community, information, financial and biotechnology, industry, construction, and services stand out.

One of the fastest growing sectors in the country is the IT industry. In recent years, Lithuania has established itself as a leading hub for technology startups, especially in areas such as artificial intelligence (AI), blockchain, cybersecurity, and software development. The government supports the development of the IT sector by creating a favorable fiscal environment, stimulating programs for startups, such as startup visas and tax incentives for research activities. Registering an IT company in Lithuania opens up access to a pool of highly qualified specialists and is characterized by relatively low operating costs.

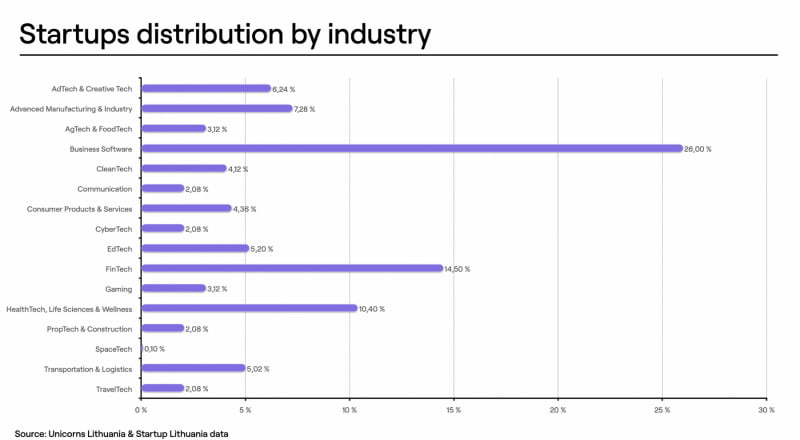

Image caption: Distribution of startups by industry (according to Startup Lithuania data).

Foreign entrepreneurs prefer to register a company in Lithuania in the biotechnology sector. The biotechnology sector has demonstrated a high level of growth in recent years. Given the existing scientific and research capacities in the field of biotechnology, pharmaceuticals and medicine, Lithuania provides unique opportunities for the establishment and development of companies operating in these areas. The country has a fairly strong network of research institutes, universities and laboratories, which facilitates innovative developments.

One of the key factors influencing foreign entrepreneurs’ decision to open a company in Lithuania is the competitive environment, particularly in high-tech sectors such as biotechnology. Significant incentives include substantial financial grants from public and private funds, guaranteed access to international markets through Lithuania’s membership in the EU, which creates significant opportunities for expanding business activities. These conditions facilitate the growth and prosperity of companies operating in the fields of research and development in genetics, pharmaceuticals and medicine, and promote the rapid development of start-ups focused on the development and production of biopharmaceuticals. Lithuania’s attractiveness to foreign players in the biotechnology market is undoubtedly due not only to access to highly qualified personnel and scientific infrastructure, but also to legal and economic mechanisms that facilitate the successful introduction of products to international markets.

Setting up a life sciences company in Lithuania is a preferred solution for those focused on developing innovations in biomedicine and pharmaceuticals. In an effort to establish itself as a regional leader in this field by 2030, the Lithuanian government is taking a set of measures aimed at creating favourable conditions for the multifaceted growth of companies operating in this strategically important sector. Today, the share of this sector in the country's gross domestic product is 2.5%, which is six times higher than the European average. In implementing the long-term state strategy, legislators set an ambitious goal of doubling this figure to 5% by 2030, which will contribute to strengthening competitiveness in the global arena and ensuring further innovative progress.

The Lithuanian industrial sector plays an important role in the country's economy, and investments in this sector will continue to increase. Given Lithuania's geographical position, strategically located at the crossroads of Europe's main trade routes, the country has significant potential for developing various manufacturing and export areas. Factors such as a high level of infrastructure development, along with the availability of highly qualified labor force, attract foreigners wishing to open enterprises in Lithuania in such industries as mechanical engineering, consumer goods manufacturing, and chemical industry. These industries contribute to the sustainable growth and modernization of Lithuanian industry, strengthening its position in global markets.

For foreign entrepreneurs considering registering a manufacturing business in Lithuania, one of the determining factors is not only the availability of a competitive fiscal policy, but also direct access to highly developed EU markets. Lithuania has demonstrated stable growth in manufacturing, especially in the field of environmentally friendly and sustainable technologies, which significantly increases its attractiveness for investors focused on conformance with environmental standards and the implementation of projects based on the principles of sustainable development.

Another area that deserves attention from foreign entrepreneurs planning to set up a company in Lithuania is software engineering. The level of saturation of this market in Lithuania is below average, which provides significant opportunities for startups and technology companies. This allows potential software developers to expand their operations, focusing on dynamic development, taking into account more flexible business conditions.

For long-term strategic planning and diversification of business activities, it is possible to register a company in Lithuania specializing in the construction industry. The construction sector continues to demonstrate growth, attracting significant investment in both the residential and commercial real estate markets. Given the growing demand for quality housing and the need to modernize infrastructure, construction is becoming an important part of the Lithuanian economy. In recent years, the country has seen an increase in residential construction, as well as the development of commercial real estate, including office space and shopping centers.

Investments in the construction sector are driven not only by the growing demand for real estate, but also by improved conditions for foreign investors. Lithuania offers transparent urban planning legislation, preferential conditions for the design and implementation of construction projects. Thanks to these conditions, Lithuania continues to attract investors interested in implementing large construction projects, especially in large cities such as Vilnius and Kaunas.

The services sector is showing a high level of growth, especially in such areas as tourism, education, healthcare, legal and financial services. Opening a company in Lithuania can be quite profitable for servicing international corporations, including business services outsourcing and providing professional consulting services. Particular attention should be paid to tourism, which continues to recover and develop. Lithuania, with its rich historical and cultural heritage, unique nature and numerous tourist attractions, attracts not only foreign tourists, but also investors interested in developing tourism infrastructure.

Fintech is one of the fastest growing sectors of the economy. The country is a recognized hub for fintech startups, due to the favorable legislative environment created to support and develop innovative financial solutions. Lithuania was included in the top countries in the Global Fintech Index. Setting up a fintech business in Lithuania allows for the introduction of digital innovations into the financial sector. In particular, the possibility of creating and operating payment institutions and issuers of electronic money is of great interest to foreign entrepreneurs.

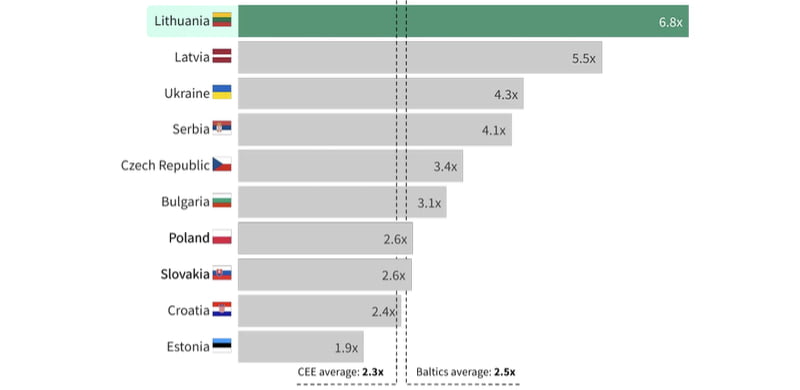

Lithuania has all the necessary infrastructure for creating innovative financial services such as cryptocurrency exchanges, investment and credit solution platforms. The government supports fintech startups with various initiatives such as tax incentives for research and venture financing. It is worth mentioning that last year Lithuania ranked third in terms of venture capital investments in fintech and second in terms of blockchain investments among Central and Eastern European countries.

Caption: Key sectors of the Lithuanian economy by volume of venture capital investments.

Opening a company in Lithuania : what do you need to know about taxes?

Charge arrangement has a noteworthy effect on key arranging and decision-making when surveying conditions for entering the advertisement. In the setting of globalization and a profoundly competitive environment, it plays a definitive part in analyzing the financial engaging quality of a nation. An appropriate understanding and evaluation of charge arrangement, counting rates, monetary motivations, and authoritative control practices, are fundamentally viewpoints in deciding lawful and budgetary supportability in an unused market.

From 1 January 2025, a standard corporate charge rate of 16% was presented. Little businesses and agrarian companies can take advantage of a decreased rate of 0 or 6%, subject to administrative criteria. An expanded wage charge rate of 21% (16% of the fundamental rate furthermore a 5% additional charge) was presented for the benefits of credit education surpassing 2 million euros.

The essential VAT rate is 21%. In any case, for certain exchanges, diminished rates of 9% and 5% are built up. Supplies of merchandise expecting to be sent out outside the EU or supplies of products planning for VAT payers enlisted in other EU Part States are absolved from VAT and are burdened at a rate of 0%.

Income of a outside legitimate substance gotten from Lithuanian sources without setting up a lasting foundation here is subject to tax collection concurring to the taking after scheme:

- Interest on obligation commitments is subject to a 10% tax.

- Income emerging from the distance, exchange, or rent of realty found in the region of Lithuania is subject to a 16% tax.

- Distributed benefits are subject to charge at 16%.

- Royalties are subject to tax collection at a rate of 10%.

When deciding to open a business in Lithuania, it should be taken into account that, according to the provisions of the European Commission Interest and Royalties Directive, the tax rate on royalties paid to affiliated persons in the Republic of Lithuania is 0%. It is important to note the presence of one of the key tax preferences in force in the country - benefits provided in support of research and development (R&D), which significantly reduce the fiscal burden on enterprises engaged in innovative activities.

The right to apply the reduced 6% tax rate is granted to firms subject to two conditions:

- income from the exploitation, sale, transfer of rights to property goes exclusively to the Lithuanian division or individual enterprise that is the creator of this property, and only the specified persons bear all costs associated with obtaining this income;

- the property is an object of intellectual property protected by copyright, or an invention that meets the criteria of patentability, including novelty, conformance with the parameters of inventiveness, industrial applicability, and is protected by a patent or a certificate issued by the European Patent Office or the authorized bodies of a member state of the European Economic Area or a state with which an agreement on the prevention of double taxation has been concluded.

Registration of a company in the Lithuanian free zone gives the right to a full exemption from corporate tax for the first ten years, a 50% reduction in the rate for the next six years (subject to conformance with the regulatory requirements). Additionally, registration of a company in the Lithuanian FEZ is exempt from property tax. These benefits apply only to entities registered in the FEZ and actually operating in this zone, subject to the following conditions:

- The amount of capital investment (with written confirmation from the auditor) is at least EUR 1 million or, in the case of smaller capital investments (at least EUR 100,000), the average number of employees in the tax year is at least 20 people.

- At least 75% of annual income is received from activities carried out on the territory of the SEZ.

All companies are required to properly document their financial activities, prepare and submit annual financial statements. For medium and large organizations, the mandatory submission of a full set of financial statements is provided, while for small enterprises, the use of a simplified form of reporting is allowed. In addition, if the organization meets at least two of the following criteria, it is obliged to undergo a mandatory audit:

- annual income over 3,500,000 euros;

- asset value over EUR 1,800,000;

- the number of employees is 50 or more people.

Accounting services in Lithuania are an integral part of managing financial flows and conformance with regulatory requirements. In the context of globalization and the complication of tax legislation, engaging specialists providing accounting support in Lithuania is becoming a reasonable step for legal entities seeking to optimize tax liabilities and minimize legal risks. You can contact qualified specialists of our company, who will provide a full range of business support services in Lithuania, including not only legal advice and assistance in registering enterprises, but also full accounting services, which will ensure conformance with all regulatory standards and minimize risks associated with financial obligations.

Conclusion

Lithuania, the largest country in the Baltic region, maintains its status as a dynamic and strategically important economic centre, playing a key role in international trade and commerce. Due to its convenient location and direct access to the markets of neighbouring countries, Lithuania serves as an important transport and financial hub, which significantly expands the possibilities for cross-border transactions.

A tax regime with preferential conditions, stability and reliability of the banking infrastructure, a highly developed logistics network serve as weighty arguments for foreign applicants in their decision to register a company in Lithuania. In addition, local legislation provides that investments in business in Lithuania are a legally justified reason for obtaining the right to immigration and residence of foreigners. Contact the specialists of our company if you are interested in comprehensive legal support in the process of registering a business in Lithuania.

Crypto license in Lithuania

Crypto license in Lithuania  Enlist a charter for virtual currency in Lithuania

Enlist a charter for virtual currency in Lithuania  ICO in Lithuania

ICO in Lithuania