A financial licence in Belize is a permit issued by the country's regulatory authority to conduct various activities such as banking, asset management, insurance, investment funds, etc. The licence is issued after a thorough review of the application and verification of the applicant's compliance with the requirements of local legislation and international standards governing the financial sphere.

The purpose of issuing a licence is to ensure proper control and regulation of financial activities in Belize, to protect the interests of consumers and to ensure the stability of the country's financial system as a whole. The publication outlines the requirements for obtaining a financial licence in Belize.

What are the reasons why obtaining a financial licence in Belize is attractive to foreign business persons?

If you want to enter the markets of Latin America or the Caribbean, registering a finance company in Belize may be a suitable choice. In addition to advantages such as developed infrastructure and educated human capital, the country offers an attractive tax regime.

Belize is a Caribbean land positioned on the mainland of Central America. The pecuniary sector of this territory is delineated by:

- A diversity of pecuniary amenities to encounter sundry pecuniary requisites and intents.

- The nation's banks furnish a diversity of amenities for aliens and international enterprises, incorporating multi-currency accounts, sophisticated cyber banking, and asset stewardship amenities.

- It has forged a sturdy statutory and regulatory scaffolding that accords with global benchmarks. The nation is resolute in conserving pecuniary equipoise and accomplishing anti-laundering requirements.

- Belize possesses stringent decrees safeguarding the discretion of banking and pecuniary intelligence.

- Belize refrains from levying tolls on the revenue of international financial companies (IBC), rendering this jurisdiction a compelling preference from a toll scheming vantage.

Financial regulation in Belize

The Financial Services Commission (FSC) is the overseer of the pecuniary amenities marketplace. The FSC is empowered to dispense charters for the rendering of pecuniary amenities in Belize. The Licensing and Authorisation Department of the FSC is accountable for the diurnal oversight of extant chartered pecuniary amenity purveyors.

Belize offers a full range of licences for the following areas of international financial services:

- Bookkeeping accommodations.

- Invoice remittance accommodations.

- Monetary advisement.

- Monetary renting.

- Transnational wealth safeguarding and administration.

- Cash mediation.

- Currency interchange.

- Transaction facilitation accommodations.

- Enrolled representative accommodations.

- Guardianship accommodations.

- Goods barter.

Requirements for obtaining a financial licence in Belize

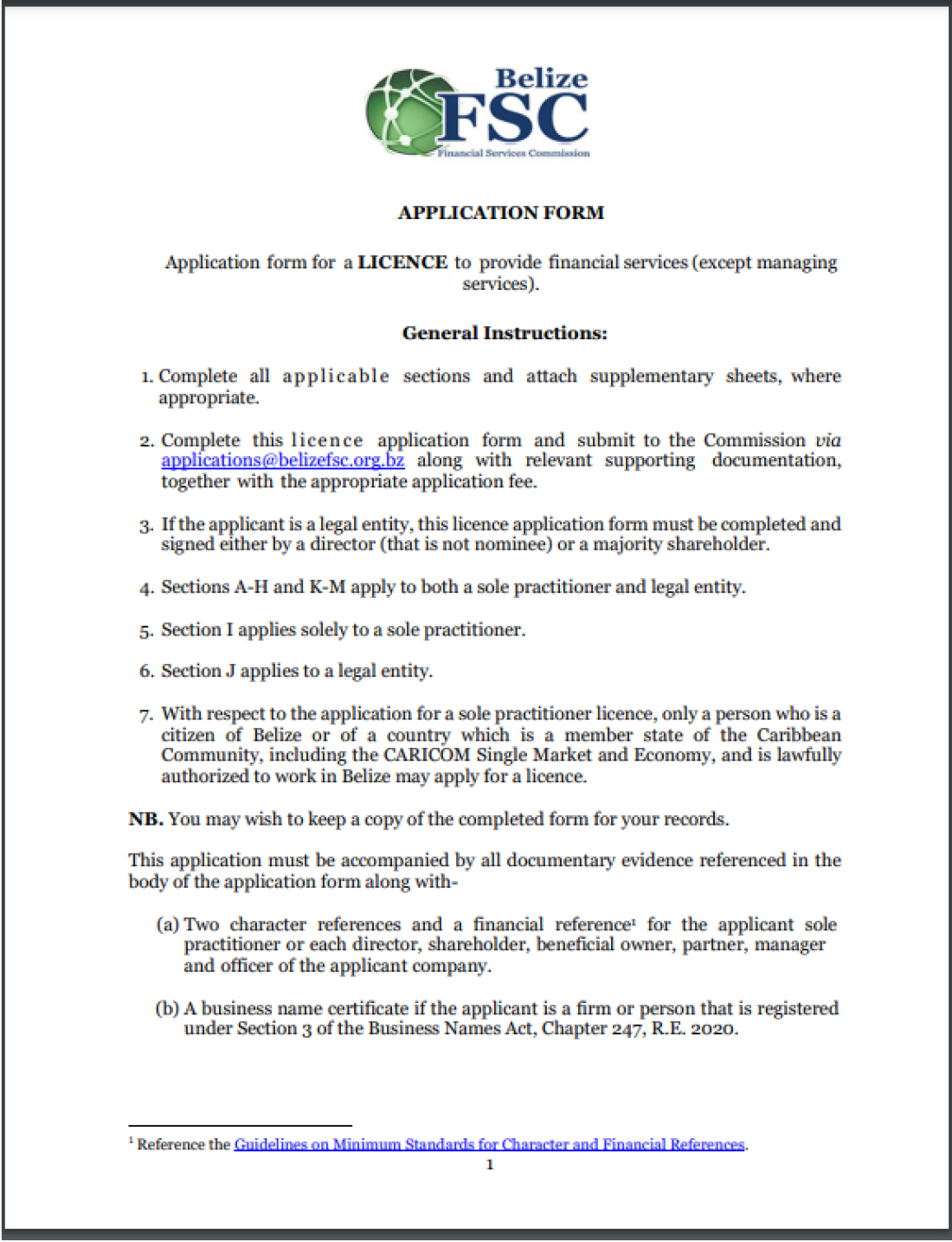

Each application for licensing with the FSC must include:

- the consummate FSC beseechment formulation;

- attestation papers for every executive;

- replica of attestation of locale (issued within the ultimate 3 moons) by a scrivener for each superintendent and stakeholder;

- attestation of remuneration of the proscribed enrollment dues;

- attestation of entirely discharged upward capital in reverence of the pursuit for which the permit befits (capital must be consigned in a Belizean pecuniary repository);

- a vocation schema and a quinquennial currency outflow presage;

- inner rule, conformity and counter-money defiling tactics and modus operandi;

- any ancillary compulsory manuscripts that may be requisite by the FSC.

The supplicant must evince that he/she possesses the requisite erudition and know-how of administering a commercial enterprise and furnish corroborative manuscripts of pertinent vocational certifications.

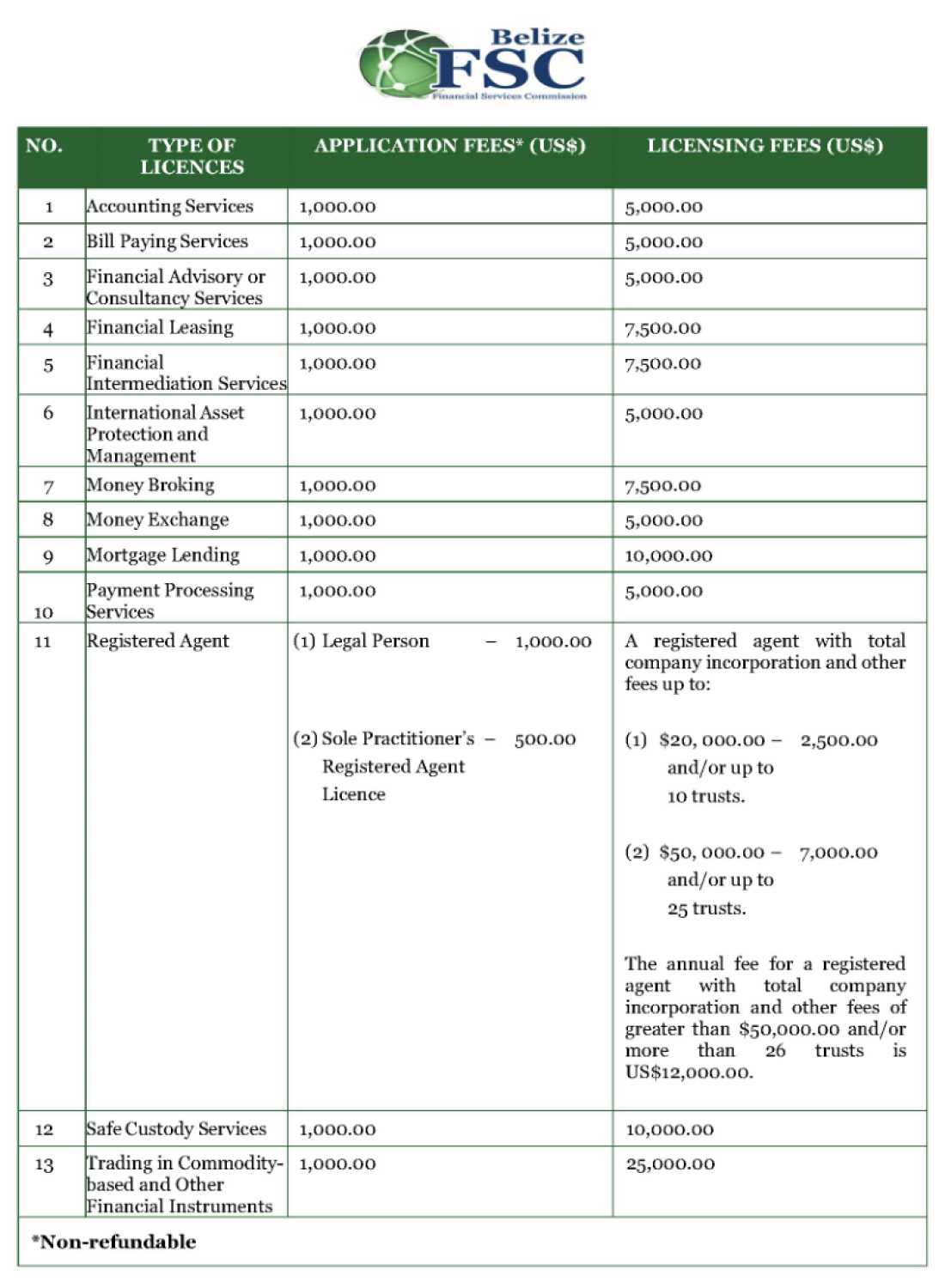

Illustration caption: minimum capital requirements for different types of financial licences.

Belize Payment Company Licence

The conferral of this permit is regarded as a temporally protracted process that unfolds through various phases:

- Registration of a legal entity in Belize. This stage includes selection of the form of organisation (e.g. limited liability company), approval of the original company name, other procedures related to business registration in accordance with the national legislation.

- Apply to the competent authority for a payment company licence in Belize. The competent authority must be provided with, among other things, the Certificate of Incorporation, business plan, data on the management of the company.

- Review of the application and issuance of the licence. Once the application has been submitted, the competent authority will conduct a review of the application. The regulator may request other information or documents if necessary. After a thorough review of the application and its compliance with the requirements of Belizean law, the competent authority will decide whether to issue a licence.

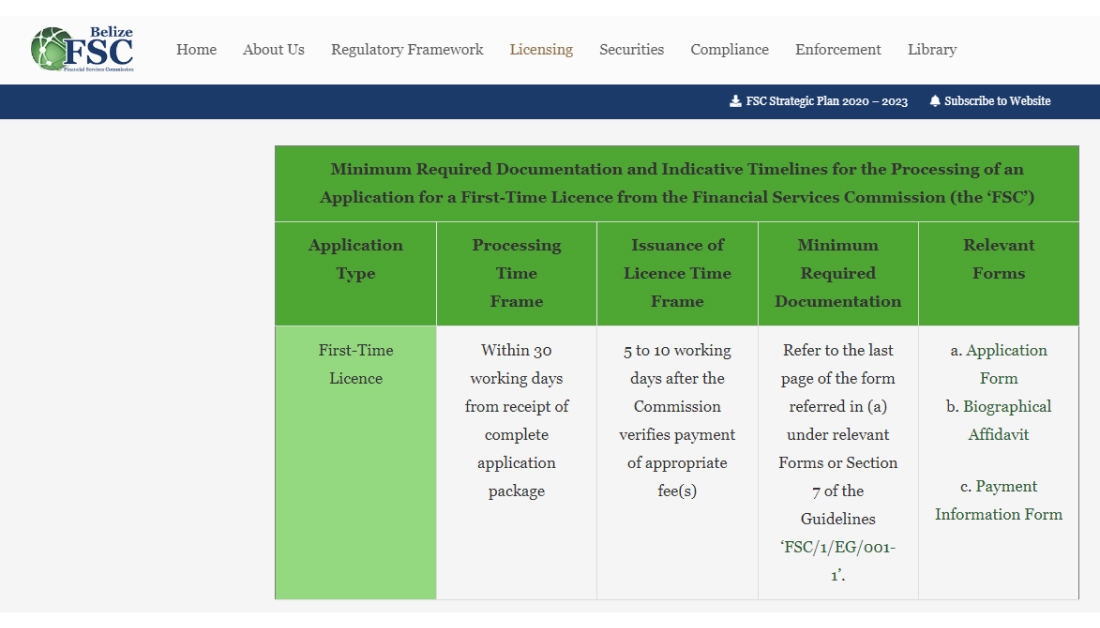

Usually the timeframe for obtaining a financial licence in Belize is about 2 months from the time the Commission receives a complete set of documents. Since the government of this jurisdiction took steps to simplify registration procedures a few years earlier, it now takes only a few days to register a company in Belize (with the assistance of subject matter experts). It takes approximately 30 days for the Commission to analyse the application and licence documents, and another week (on average) for the Commission to process the licence documents (after confirmation of payment of the relevant fee by the applicant).

Illustration caption: minimum documentation required and indicative processing times for a licence application.

Subsequent to acquiring a Belize disbursement privilege, it is imperative to rigorously adhere to the mandates delineated by the regulatory entity. These encompass conformity with statutes concerning anti-funnelling and the subsidization of illicit dealings, upholding a specific threshold of funds, and disclosure.

Obtaining a licence to operate a payment company in Belize entitles you to carry out the following activities:

- Supply of amenities concerning emplacement of funds on the ledger and their ensuing retrieval.

- Execution of dealings with the utilization of payment cards.

- Execution of pecuniary transfers.

- Execution of fund transferences.

- Supply of mediation amenities between a payment service patron and a merchandise purveyor.

For an entreaty for a charter to be sanctioned by the overseer, the franchisor enterprise must affirm that the configuration has at least duo overseers, one of whom must be a inhabitant of Belize, and professional compensation insurance is established. Illustration caption: licence renewal application form.

Illustration caption: licence renewal application form.

Payment for the FSC licence:

- Application fee 1000 USD.

- Payment for the annual licence 5000 USD.

- The annual payment must be paid before 1 January.

Belize Broker's Licence: Key Aspects and Benefits

Acquiring a forex broker licence in Belize permits the brokerage firm to function lawfully in the marketplace, function under the oversight of the regulatory entity, and offer secure guardianship of patron funds. To acquire a forex licence in Belize, it is crucial to comprehend the fundamental prerequisites of the jurisdiction.

Enrollment of a firm occupied in brokerage amenities necessitates a minimum of one governor and one partaker (who might be a singular or corporate, might be non-resident). It is crucial to devise and present schemes to guarantee utter secrecy and safeguard of patron information.

The overseers of the enterprise must possess expertise and pertinent credentials in the brokerage sphere. It is additionally imperative to inaugurate a Belizean banking ledger, remit requisite funds, and settle all pertinent charges.

To procure the requisite permit, the petitioner corporation must satisfy minimal pecuniary prerequisites:

- Barter in exotic coinage and sundry pecuniary implements (USD 100,000).

- Currency exchange (USD 75,000).

- Cash transactions, financial transfers, brokerage, lending (USD 50,000).

- Providing professional accounting services, consulting (USD 25,000).

Observation. The principal inventory of the enterprise is consigned and persists in a banking repository whilst the enterprise is occupied in licensure undertakings. Tangible manifestation alongside indigenous overseers in the enterprise configuration is a stipulation for acquiring a broker's permit in Belize.

By the way, conducting financial activities without the appropriate licence in Belize can lead to significant fines, penalties and other legal consequences.

If the offence was committed for the first time:

- Minimum fine 5,000 USD.

- Maximum fine 25 000 USD.

Repeat offence:

- Minimum fine 25,000 USD.

- Maximum fine 50,000 USD.

In some cases criminal prosecution may be applied for conducting financial activities without a licence + fine, which may be linked to turnover

Opening a company in Belize for financial activities: legal forms of companies

Belize proffers a multiplicity of firm genres apposite for sundry commercial requisites and stratagems. Comprehending the configuration and intentions of every establishment will assist you in crafting a judicious resolution. Ordinarily, foreign impresarios select one of a duet of sorts.

An International Business Company (IBC) is a variety of overseas firm frequently employed for global commerce and investment. A Belize International Business Company is for all lawful intents and purposes a distinct lawful entity. A Belize IBC is absolved from indigenous levies provided the trade is carried out beyond the nation. A corporation in the configuration of a CTS is not eligible to possess landed property in Belize, but can participate in a diversity of mercantile pursuits.

A limited liability company (LLC) furnishes pliancy and safeguard with delimited accountability for its constituents. The originators are accountable for liabilities and duties commensurate with their inputs to the portion assets. An LLC integrated in Belize is an autonomous juridical person. Belize LLC is excused from all indigenous levies (corporate profit levy, capital earnings levy, etc.) on gains garnered beyond Belize.

Belizean LLCs are not subject to economic presence requirements:

- have a sufficient number of qualified personnel to support the company's core operations in Belize;

- the level of expenses should be appropriate for the size of the business and the type of activity;

- control and management of the company must be exercised from Belize.

The process of registering a company in Belize involves several important steps:

- Choosing a concern appellation that accords with indigenous statutes, assuring that the appellation is not utilized or akin to appellations of aforetime enrolled concerns.

- Appointment of directors. A minimum of two (2) resident directors and one (1) member must be appointed for a Belizean company wishing to conduct financial business.

- Contracting a local agent who will be responsible for accepting legal documents on behalf of your company and ensuring compliance with local laws.

- Preparation of a complete set of documents as required for the specific organisational form of the company.

- Submission of the application and documents to the regulator for review.

After completing the basic registration steps, it is necessary to decide on the bank in which to open an account for the Belize company.

Visas for investment in Belize companies

Belize is popular as a place to register an offshore company, however, it is not a jurisdiction that allows investors to obtain citizenship after making an investment. Although there is NO official programme for obtaining Belizean citizenship for investment, investors may be granted a temporary residence permit.

The Belize Temporary Residency Programme is intended for entrepreneurs who make business investments in this jurisdiction of at least 500,000 Belizean dollars (about 250,000 US dollars). A permit obtained in this way has a validity of one year and can be renewed. There is no fixed sector for business to invest in.

Conclusion

A financial licence in Belize is an authorisation document that certifies your company's right to carry out the prescribed activities. TK Deal specialists can provide detailed advice on the options of licence registration for international financial activities.

If you have resolved to enroll a corporation in Belize and petition for a permit for pecuniary undertakings, our squad is primed to furnish the requisite backing in acquiring Belize pecuniary permits at every juncture.

Forex license in Belize

Forex license in Belize  Obtaining a banking license in Belize

Obtaining a banking license in Belize  Crypto license in Belize

Crypto license in Belize  PSP licence in Belize

PSP licence in Belize  Company liquidation in Belize

Company liquidation in Belize